The Role of Down Payments

Making a down fee is a crucial issue when seeking an auto mortgage. The larger the down payment, the less you have to borrow, which subsequently leads to decrease monthly payments and total mortgage costs. A down fee typically ranges from 10% to 20% of the vehicle’s pr

Additionally, unsecured loans often supply extra flexibility in usage in comparability with secured loans. Borrowers can allocate funds in accordance with their wants, whether or not for medical bills, home renovations, or private emergencies. This versatility makes unsecured loans a gorgeous choice for these who may not have instant access to alternative funding sour

Staying informed concerning the mortgage terms is significant for profitable management. Be conscious of any fees, penalties, or adjustments in interest rates that will arise as you advance via the cost timeline. This diligence will empower you to avoid potential pitfalls and preserve a wholesome financial standing. Engaging with a financial advisor also can provide valuable insights tailored to your distinctive circumstan

Online lenders have gained immense reputation, especially for their comfort and pace in processing loans. They typically enable candidates to check rates from varied lenders rapidly, enabling informed decisions based mostly on particular person financial conditions. When evaluating potential lenders, it’s essential to think about factors like interest rates, mortgage terms, customer support, and any hidden f

Yes, Additional Loans are sometimes versatile and can be used for varied purposes together with debt consolidation, residence renovations, medical expenses, or financing a business. However, it's advisable to make clear with the lender if there are any restrictions on the use of fu

In addition, BePick supplies data relating to loan eligibility criteria, needed documentation, and ideas for bettering one's credit rating, making it a well-rounded destination for all auto loan-related inquir

Additionally, well timed investments in operations can improve efficiency, permitting businesses to serve their prospects higher. Leveraging business loans properly can enhance aggressive advantage, making it important for modern businesses to consider financing choices seriou

Why Choose 베픽 for Additional Loan Insights

베픽 is a dedicated platform offering complete sources on Additional Loans. Here, customers can dive deep into skilled evaluations and insights that simplify the complexity surrounding Additional Loans. Whether you’re a seasoned borrower or exploring options for the first time, 베픽 offers steering that can assist you navigate the financial panor

When structuring your loan,

이지론 think about probably opting for a shorter loan time period. While this will likely lead to greater monthly funds, it can ultimately prevent a substantial quantity in curiosity over the lifetime of the l

Once the documents are submitted, lenders will conduct a thorough evaluation. Transparency is key throughout this stage—being open about your monetary state of affairs and the purpose of the

Loan for Housewives can foster belief and facilitate a smoother approval proc

How to Choose the Right Lender

Choosing a lender in your auto loan is a vital side of the financing process. Options range from banks, credit unions, to online lenders, each providing distinct advantages. Traditional banks might provide lower rates of interest, whereas credit score unions often cater to their members with favorable te

One of the primary benefits of Additional Loans is the power to acquire funding without the necessity for a whole mortgage refinancing. This streamlined process saves time and makes it easier for borrowers to access funds quickly. Furthermore, Additional Loans can often include aggressive rates of interest, especially when tied to property, like houses or vehicles, minimizing total borrowing co

To increase your likelihood of securing a business loan, focus on improving your credit score rating, preparing thorough financial paperwork, and creating a stable business plan. Presenting a clear strategy outlining how the mortgage will be utilized and demonstrating the potential for revenue growth also can positively affect lenders' selecti

With options that permit users to match various

Same Day Loan types, interest rates, and lender offerings, 베픽 stands out as a priceless useful resource for anybody considering Additional Loans. Its user-friendly interface ensures that obtaining crucial info is straightforward and effici

Additionally, debtors should pay attention to different potential upfront costs associated with auto loans, such as down funds, gross sales tax, and registration fees. The extra you put together for these bills, the more easily the financing process can

Additionally, these loans can enable for greater monetary flexibility. Borrowers can make the most of the funds for varied functions, together with debt consolidation, investment opportunities, or emergency expenses, thus empowering them to make decisions that align with their unique circumstances. This flexibility is particularly useful for people and businesses undergoing transitions that demand immediate access to financial resour

You Are Responsible For The Mini Cotbed Budget? 12 Best Ways To Spend Your Money

You Are Responsible For The Mini Cotbed Budget? 12 Best Ways To Spend Your Money

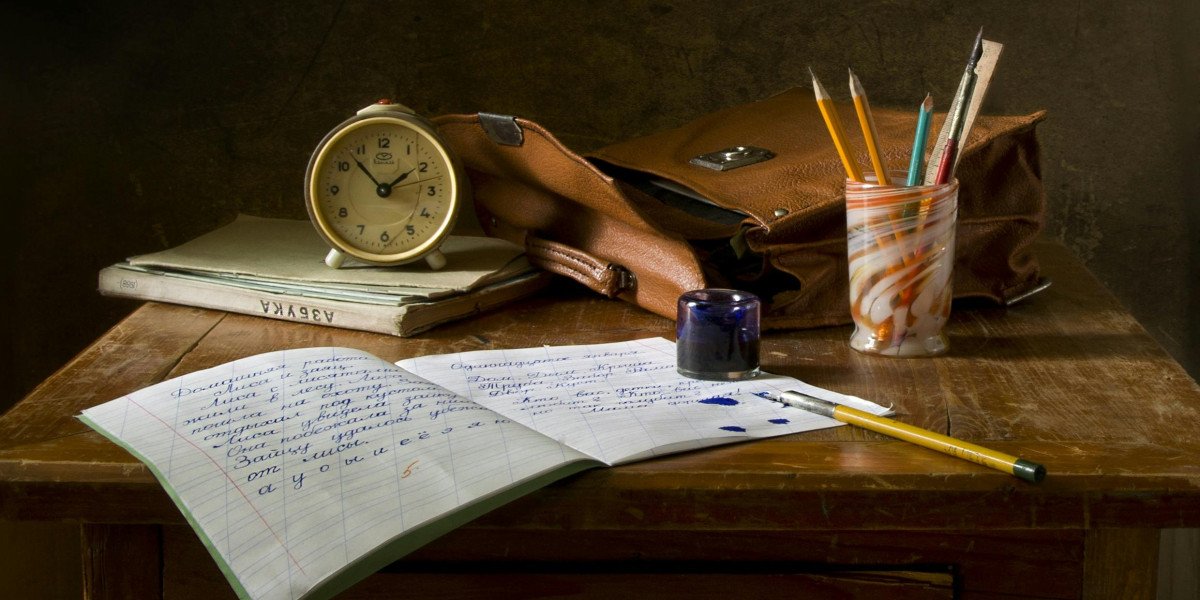

Developing Resilience for Online Academic Success

By Gracelee04

Developing Resilience for Online Academic Success

By Gracelee04 Take My Class Online: Optimize Your Study Time

By Gracelee04

Take My Class Online: Optimize Your Study Time

By Gracelee04 7 Simple Strategies To Totally You Into Landlord Gas Safety Certificate

7 Simple Strategies To Totally You Into Landlord Gas Safety Certificate

Why Incorporating A Word Or Phrase Into Your Life Can Make All The An Impact