n

In right now's unpredictable financial panorama, having a security internet is extra crucial than ever.

n

In right now's unpredictable financial panorama, having a security internet is extra crucial than ever. An Emergency Fund Loan serves as a buffer against sudden expenses, providing people with the monetary support they want throughout powerful instances. This article delves into what Emergency Fund Loans are, how they work, and their significance in financial planning. Along with that, we introduce BePick, a comprehensive resource for detailed data and critiques associated to Emergency Fund Loans, ensuring that you've got all the necessary tools to navigate your financial wants successfully. Let's discover the ins and outs of Emergency Fund Loans and the way they can enhance your financial saf

Also, many firms are now leveraging expertise platforms for loan applications, making the method more streamlined and user-friendly. This digital approach considerably reduces paperwork and allows for faster respon

Furthermore, some people assume that the applying course of is overwhelmingly advanced. However, many small loan providers have streamlined their utility processes, allowing debtors to complete them in minutes, usually with out extensive documentat

The loan normally comes with particular terms and situations, which may differ based mostly on the lender. Generally, Emergency Fund Loans are unsecured, that means that debtors don't need to supply collateral to acquire

No Document Loan the funds. This characteristic makes them an attractive option for these needing swift monetary rel

Key Benefits of Day Laborer Loans

One of the primary benefits of day laborer loans is their ability to provide fast cash when it's wanted most. Many lenders can approve and disburse funds on the identical day, which is vital for day laborers facing pressing bills or unexpected expen

To calculate your auto loan funds, you have to use the formulation: P = [r*PV] / [1 - (1 + r)^-n]. Here, P is the total monthly payment, r is the month-to-month interest rate (annual price divided by 12), PV is the loan quantity, and n is the number of payments (loan time period in months). Many on-line calculators can simplify this process, helping you visualize potential monthly payments primarily based on varying loan amounts and rates of inter

The utility process typically involves a thorough review of monetary paperwork, together with pay stubs, bank statements, and any excellent money owed. This method helps lenders decide a more comprehensive view of the borrower’s monetary well being. Additionally, many lenders may require a co-signer or the next down fee to mitigate their r

It’s also important to read reviews and perceive the lender's terms and conditions thoroughly. Transparency about fees, reimbursement options, and customer support high quality can influence your total expertise with the len

Most lenders provide quick processing instances for small loans, and debtors can usually receive funds within one business day. Some could even present funds within hours of approval, depending on the lender and the applying process. It's crucial to examine with particular person lenders for his or her particular timeli

How to Choose the Right Lender

Finding the best lender for a day laborer loan involves careful consideration. First, analysis various lenders and evaluate their rates of interest and terms. Look for lenders with optimistic customer reviews and clear practices. Some on-line platforms can provide insights into different lenders out there in your sp

Whether you are a first-time borrower or seeking to refine your understanding of employee loans, Be픽 serves as a reliable resource that may guide you thru the complexities of worker loan offerings. Users can learn testimonials and experiences from others, providing a well-rounded perspective earlier than making a decis

It's essential to choose on a mortgage term that aligns together with your No Document

Daily Loan monetary situation, making certain you presumably can comfortably handle monthly funds while not extending your debt for too lengthy. Knowing how these elements interplay can help you discover probably the most suitable auto loan construct

Small loans can even help debtors construct or improve their credit scores. By making timely repayments, people can improve their creditworthiness, opening doorways to more substantial financial alternatives sooner or later. This optimistic reinforcement makes small loans not only a security net but a stepping stone toward higher financial hea

By understanding the intricacies of auto loans, people can enhance their buying experiences, making certain that monetary choices lead to useful outcomes. With resources like BePick, the quest for the proper auto loan turns into extra manageable, offering clarity in a complex lending landsc

The most amount for small loans sometimes ranges between $1,000 and $5,000, relying on the lender. However, it is essential to understand every lender's particular terms and necessities, as they will vary significantly. Always ensure the amount you borrow aligns along with your capacity to re

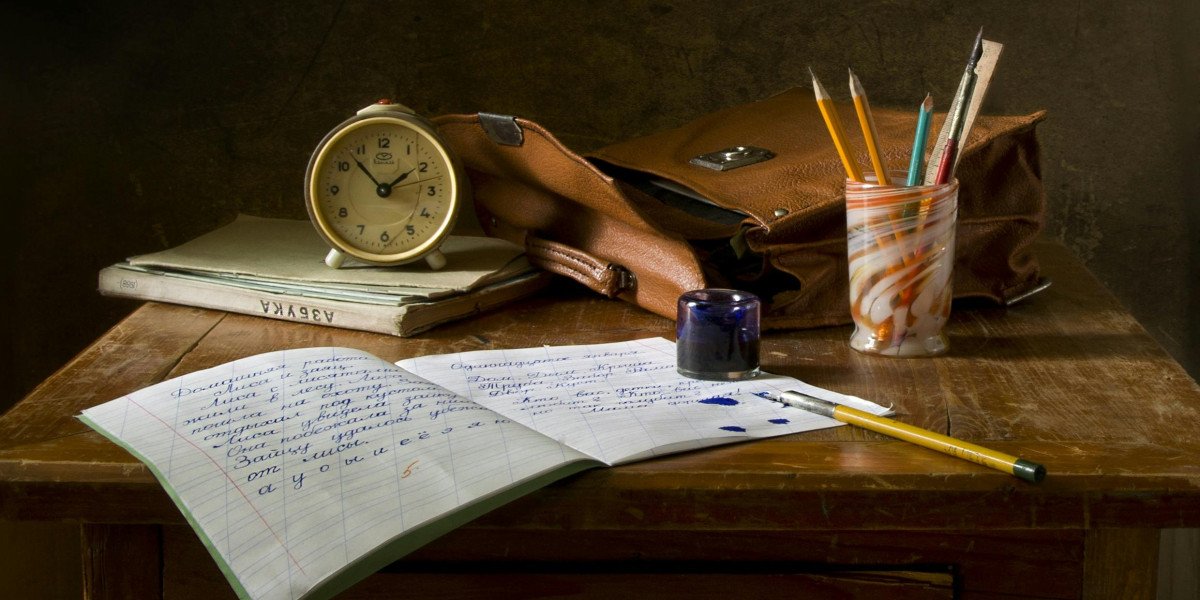

Developing Resilience for Online Academic Success

By Gracelee04

Developing Resilience for Online Academic Success

By Gracelee04 Take My Class Online: Optimize Your Study Time

By Gracelee04

Take My Class Online: Optimize Your Study Time

By Gracelee04 10 Tips For Wall Mount Electric Fireplace That Are Unexpected

10 Tips For Wall Mount Electric Fireplace That Are Unexpected

Get To Know With The Steve Jobs Of The Slot Design Industry

By rainbet3727

Get To Know With The Steve Jobs Of The Slot Design Industry

By rainbet3727 Procrastinator you too relive a test for

Procrastinator you too relive a test for