In distinction, the Direct Unsubsidized Loan doesn't require proof of economic need, making it obtainable to a broader vary of scholars.

In distinction, the Direct Unsubsidized

Unsecured Loan doesn't require proof of economic need, making it obtainable to a broader vary of scholars. However, interest begins accruing immediately, which might lead to bigger mortgage balances over t

Pawnshop loans can be a viable possibility for fast money, particularly for many who may not qualify for traditional loans. They provide immediate entry to funds without a credit score examine, but debtors must be cautious of the high-interest charges and perceive the terms earlier than agree

Managing Student

Loan for Delinquents Debt

Managing student mortgage debt effectively requires proactive financial planning and self-discipline. First and foremost, sustaining communication along with your loan servicer can provide priceless insights into your options and obligations. Ensure you’re conscious of due dates, rates of interest, and any obtainable reimbursement pl

Always discover scholarships and grants first, as these funds don't need to be repaid. Many establishments and external organizations offer monetary assist based mostly on advantage, need, or specific demograph

The web site features complete reviews of varied pawnshops, allowing users to check completely different choices of their space. By reading firsthand experiences and expert analyses, potential borrowers can understand what to expect and how to navigate the pawnshop loan process effectiv

No Credit Check: Many lenders offering 24-hour loans don't require a conventional credit check, which could be a plus for people with poor or no credit score history. Instead, they could assess other factors corresponding to income and employment stabil

In at present's unpredictable financial panorama, having an emergency fund mortgage can present an important safety net for individuals facing unexpected expenses. Such loans are designed particularly for pressing financial wants, providing a swift and accessible resolution when life throws unforeseen challenges. This article will delve into what emergency fund loans are, their advantages, application processes, and the way they can be instrumental in financial planning. Additionally, we'll introduce BePick, a complete platform for data and critiques on emergency fund loans, empowering borrowers with the information they want to make knowledgeable choi

It's also crucial to note that personal loans typically lack the flexible reimbursement options that federal loans provide. Insurance in opposition to job loss, income-driven compensation plans, or options to defer payments are often unavailable, making it important to rigorously consider how these loans will match into your financial p

Furthermore, sure federal student loans come with benefits like deferment and forbearance choices, permitting graduates to handle their fee schedules according to their monetary situations post-graduat

Once your utility is approved, you probably can usually anticipate to receive funds within 24 hours, usually as quickly as the subsequent business day. Some lenders may supply even sooner options or same-day funding, depending on their insurance policies. However, it is essential to verify together with your lender about their specific timelines and any processing fees that will ap

Repayment Strategies

Repaying student loans can appear overwhelming, but using effective methods can ease the burden. It is crucial for debtors to grasp the phrases of their loans right from the outset. Various reimbursement plans can be found, including commonplace, graduated, and income-driven reimbursement plans, every tailored to accommodate completely different monetary situati

The Importance of Credit Score

Your credit score plays a pivotal function within the scholar mortgage course of, notably when considering personal loans. A larger credit score rating generally ends in lower interest rates, which might translate into significant financial savings over time. Managing existing credit score accounts responsibly can enhance one’s credit

Loan for Unemployed rating and make borrowing more reasonably pri

The quantity borrowed is usually a percentage of the merchandise's appraised value, usually ranging between 25% to 60%. This high-interest price is justified due to the quick entry to cash and the inherent risks of such loans. Borrowers don't must bear credit checks; thus, pawnshop loans are accessible to people with poor credit score histories, making them a beautiful option for m

Reputation of Lenders: Not all lenders operate beneath the identical standards. Research potential lenders completely, reviewing suggestions and ratings that present insight into their reliability and customer serv

Additionally, some students might qualify for PLUS Loans, that are designed for graduate and professional students or parents of dependent undergraduate students. These loans require a credit score verify and might have larger rates of interest, making them much less favorable unless completely nee

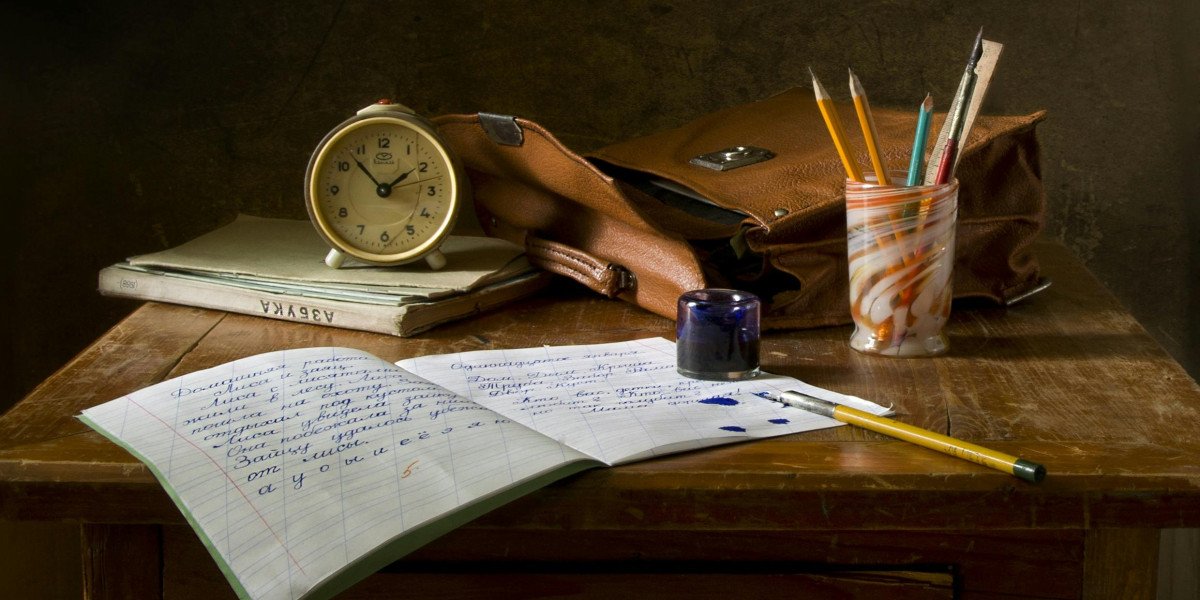

Developing Resilience for Online Academic Success

By Gracelee04

Developing Resilience for Online Academic Success

By Gracelee04 Take My Class Online: Optimize Your Study Time

By Gracelee04

Take My Class Online: Optimize Your Study Time

By Gracelee04 10 Tips For Wall Mount Electric Fireplace That Are Unexpected

10 Tips For Wall Mount Electric Fireplace That Are Unexpected

Get To Know With The Steve Jobs Of The Slot Design Industry

By rainbet3727

Get To Know With The Steve Jobs Of The Slot Design Industry

By rainbet3727 Procrastinator you too relive a test for

Procrastinator you too relive a test for